Combination Annuity and Long Term Care Insurance Versus Traditional Long Term Care Insurance – Long Term Care University – 05/15/14

Long Term Care University – Question of the Month – 05/15/14

Research

By Aaron Skloff, AIF, CFA, MBA

Q: What are the advantages of a Combination (or Hybrid) Annuity and Long Term Care insurance policy versus a Traditional Long Term Care insurance policy, and vice versa?

The Problem – Paying for Long Term Care Insurance, but Never Needing It

What happens to all those premiums you pay for a Long Term Care (LTC) insurance policy if you pass away and never use the policy? The same thing that happens to all those premiums you pay for a homeowners insurance policy if you pass away and never use the policy – the insurance company keeps them and you are happy you never had a claim. But, simply having peace of mind over the life of your policy may not be good enough. You may feel like you are getting a better value if you definitively get something back for the premiums you paid the insurance company. Insurance companies have two solutions to meet your needs.

The Solution – Combination Life and Long Term Care Insurance with Shared Care Option

The first is a Traditional LTC insurance policy with a Refund of Premium (ROP) Rider. A Traditional policy pays either a LTC benefit, a refund of premiums paid or both if you use only a portion of the LTC benefit. The second is a Combination (or Hybrid) Annuity and LTC insurance policy. A Combination policy pays either a LTC benefit, a second to die death benefit or both if you use only a portion of the LTC benefit. It also has a refund of premium at any time if the policy is cancelled. We review the advantages of each below.

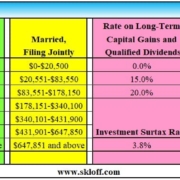

Insurance companies price policies based on their risk. There is a 7 in 10 risk you will need LTC if you live past the age of 65. There is a 10 in 10 risk you will die. Insurance companies charge more for Combination policies than Traditional policies because they are taking on more risk. Traditional and Combination policies have unique advantages compared to one another, as seen below.

| Traditional Long Term Care Insurance Advantages | Combination Annuity and LTC Insurance Advantages |

| 1. Highest benefits for the lowest price | 1. Large one time premium payment |

| 2. Options: waiver of premium when you go on claim, restoration of benefits when you recover, refund of premium at death, shared benefits for partners and spouses | 2. You get your money back in a the form of a long term care benefit, a death benefit or both |

| 3. Partnership Program Medicaid Asset Protection option | 3. Policy can be canceled with a refund of premium at any time |

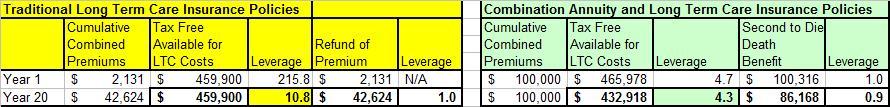

Numbers Speak Louder than Words. Let’s look at a husband and wife that are each 60 years old and are comparing two Traditional policies to one shared Combination policy. With the Traditional policy they each purchases $105 per day of LTC benefits, six years (12 years combined) of care per person with the refund of premium option. With the Combination policy they each purchase $3,377 per month ($113 per day) of LTC benefits, a shared 11.5 years of care and a second to die death benefit.

As seen below, after they pay a combined $2,131 annual premium they will immediately have a combined $459,900 tax free pool of money available for LTC costs on the Traditional policies. That gives them 215.8 times leverage on their investment. In 20 years, when they are 80 years old and likely to need LTC, they will have a combined $459,900 tax free pool of money available for LTC costs or 10.8 times leverage on their investment and a combined $42,624 refund of premium or 1.0 times leverage.

Following a combined one time payment of $100,000 their Combination policy will immediately provide a combined $465,978 tax free pool of money available for LTC costs and a $100,316 second to die death benefit. That gives them 4.7 and 1.0 times leverage, respectively. In 20 years, they will have a combined $432,918 and $86,168 or 4.3 and 0.9 times leverage, respectively.

Click to Enlarge

Action Step – Purchase a Combination Life and Long Term Care Insurance Policy with Shared Care

Since there is no free lunch in the eyes of the insurance companies, determine if you want a Traditional policy with a refund of premium or a Combination policy with a second to die death benefit.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.