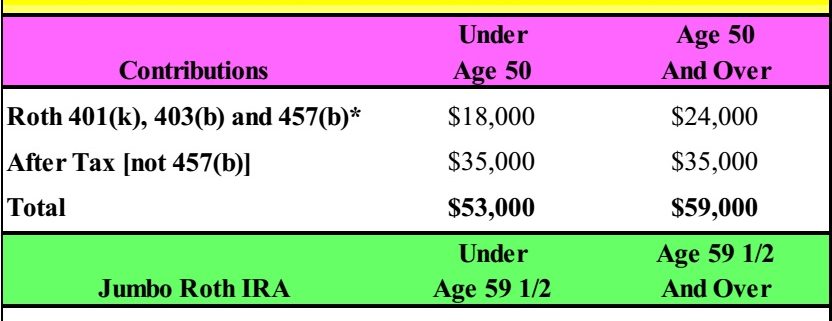

Jumbo Roth IRA 2016

Click to Enlarge

Create a Jumbo Roth IRA with a Tax Free In-Service Withdrawal and Rollover

If you are under the age of 50 you can contribute a combined $53,000 to your employer plan ($18,000 Roth plus $35,000 after tax). If you are 50 or over you can contribute $59,000 ($24,000 Roth plus $35,000 after tax). You can then complete a tax free in-service withdrawal and rollover the after tax portion if under age 59 ½ to a Roth IRA or the entire amount if age 59 ½ and over, if your employer offers this option.

Fortunately, you can repeat this process every year. This chart summarizes the process.