More Firms Roll Out Roths – Wall Street Journal – 02/09/13

The Wall Street Journal

Weekend Investor – March 9, 2013

More Firms Roll Out Roths

By Kelly Greene

Many employers are planning to add a Roth 401(k) option to their offerings of corporate benefits in the next 12 months, a new survey suggests, making it easier for workers to save money that can be withdrawn tax-free in retirement.

A provision in the tax law enacted in early January gives workers a chance to stockpile more tax-free earnings—but only if their employers’ 401(k) plans include a Roth option, along with the ability to move assets workers already have saved in tax-deferred 401(k) accounts.

The attraction: While workers converting tax-deferred savings would have to count the assets converted as ordinary income, and pay an upfront tax bill, future earnings and retirement withdrawals generally would be tax-free. And even though Roth 401(k)s generally require mandatory retirement distributions starting at age 70½, retirees could roll the assets into Roth individual retirement accounts to avoid them.

Under the old rules, assets that could be moved to a Roth account were limited to amounts that workers were allowed to withdraw—typically when they left their job, retired or reached age 59½. Now, under the new law, workers of any age or employment status can move pretax savings to a Roth account within their employer’s plan—as long as the plan allows it.

Comments February 9, 2013

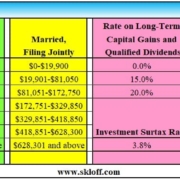

The American Taxpayer Relief Act of 2012 actually creates a minefield of new taxes. Effective January 1, 2013, you may be subject to a whole host of additional tax responsibilities. Think of it like a domino effect: as your income increases, the income tax rate you pay on that income increases, your capital gains and dividend tax rates increase and your deductions and exemptions phaseout. This all leads to additional tax responsibilities. Conversions of Traditional IRAs to Roth IRAs and/or Traditional 401(k)s to Roth 401(k)s can further add to those tax responsibilities.

That is why it is critical to evaluate the implications of conversions. Partial conversions may avoid the domino effect, while full conversions may exacerbate the domino effect. Utilizing health savings accounts (HSAs) and flexible spending accounts (FSAs), deferring income, timing the exercise of company options and realizing long term instead of short term capital gains and a host of other financial planning activities may offset the tax effects of a conversion and protect you from unnecessary taxes.

Work closely with a Register Investment Adviser (RIA), which is obligated by law to act in your best interest, to plan your best course of action.

Aaron Skloff, AIF, CFA, MBA

CEO – Skloff Financial Group

http://skloff.com

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.