Stretch IRA: Avoid Withdrawals and Taxes as Long as Possible – 10/01/16

Money Matters – Skloff Financial Group Question of the Month – October 1, 2016

By Aaron Skloff, AIF, CFA, MBA

Q: Can my family inherit my Traditional Individual Retirement Account (IRA)? If so, are there any advantages to avoiding withdrawals from my IRA?

The Problem – Required Minimum Distributions (RMDs)

If you do not properly designate your family as the beneficiaries, your IRA could be destroyed by taxes. Like most good things, avoiding withdrawals and the taxes associated with those withdrawals from your IRA, must come to an end at some point. Note: the original owner of a Roth IRA is exempt from Required Minimum Distributions (RMDs). The IRS mandates RMDs each year once you turn 70 ½ years old. This forces you to take withdrawals from your IRA. Forget to take them and you could pay 50% penalties on the amount not withdrawn.

The Solution – Stretch IRA

Naming your family as the designated beneficiaries on your IRA allows your family to inherit your IRA and simultaneously take advantage of a Stretch IRA. A Stretch IRA is not a different type of IRA, but simply a strategy of “stretching” the tax sheltering benefits of an IRA beyond your own life. Taking only the RMDs leaves your family the largest amount possible from your IRA.

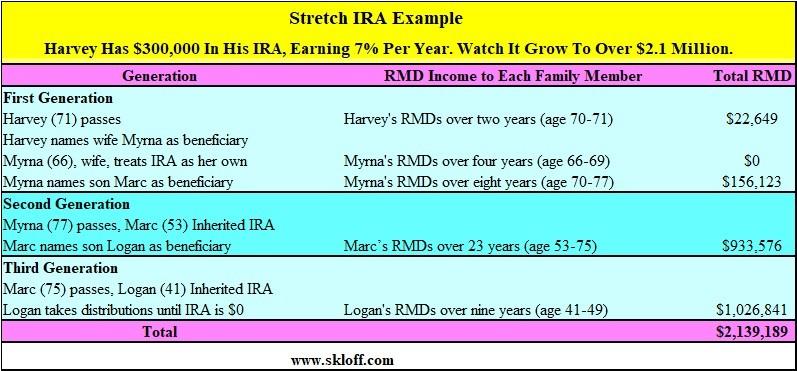

Let’s look at an example of a $300,000 IRA that grows and stretches into $2,139,189 over three generations, based on a 7% annual rate of return. Harvey (age 70) names his wife Myrna as his sole beneficiary and over two years takes RMDs of $22,649 until passing away at age 71. Myrna (age 66) treats Harvey’s IRA as her own, names her son Marc as her sole beneficiary and over eight years takes RMDs of $156,123, until passing away at age 77. Myrna is able to treat Harvey’s IRA as her own because she is his spouse. Once it becomes her own IRA she is able to delay RMDs until she turns 70 ½ years old.

Marc (age 53) maintains the account as an Inherited IRA, names his son Logan as his sole beneficiary and takes RMDs of $933,576 (based on his own life expectancy of 32 years) over the course of 23 years, until passing away at age 75. Marc is only able to treat Myrna’s IRA as an Inherited IRA (unless he disclaims ownership within nine months of Myrna’s death) versus treating it as his own.

Logan (age 41) takes RMDs of $1,026,841 (based on Marc’s remaining life expectancy until assets are divested) over the course of nine years. Logan takes RMDs for nine years because his father Marc had taken RMDs for only 23 of his 32-year life expectancy (32-23 = 9). In total, RMDs total $2,139,189 over three generations. Please see the table below.

Click to Enlarge

Compound Interest Inside of an IRA. At a 7% compound interest rate your investment will double its value in approximately 10 years. Compound interest inside of an IRA allows you to realize compound interest on a tax sheltered basis that can stretch over multiple generations. Importantly, earning 7% interest in an IRA is equivalent to earning approximately 11% interest in a taxable account and paying taxes at a 35% federal income tax rate.

Action Steps

Delay withdrawals from your IRA until required by the IRS, designate appropriate beneficiaries and instruct the beneficiaries to withdrawal at the pace required by the IRS and your family can reap the befits of your IRA over multiple generations. Establish an IRA as early as you can and let the compounding and tax sheltering begin.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA), Master of Business Administration (MBA) is CEO of Skloff Financial Group, a Registered Investment Advisory firm. He can be contacted at www.skloff.com or 908-464-3060.

Click Here for Your Long Term Care Insurance Quotes