1035 Tax-Free Exchange Long Term Care Insurance – Long Term Care University – 12/15/15

Long Term Care University – Question of the Month – 12/15/15

Research

By Aaron Skloff, AIF, CFA, MBA

Q: Can I use an annuity or life insurance policy to pay for a long term care insurance policy? Are there any tax implications?

The Problem – Money Tied Up in an Annuity or Life Insurance, But Need for Long Term Care Insurance

Many consumers purchase an annuity or life insurance policy based on their existing and future needs. As those needs change they realize their existing contracts and policies are inadequate.

For example, the life insurance policy you bought when you were 25 years old has protected your family for the last 30 years. Now that both of your grown children are on their own the need for all that life insurance is unnecessary, while the need for Long Term Care Insurance (LTCI) is necessary.

The Solution – Exchange Your Annuity or Life Insurance for Long Term Care Insurance on a Tax-Free Basis

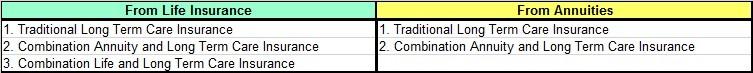

The Pension Protection Act of 2006 added additional flexibility to Internal Revenue Code 1035. Applying these concepts allows annuity contract owners and life insurance policy owners to purchase a new product by using the money inside of their old products. The process is oftentimes described as a “1035 exchange”. More importantly, 1035 exchanges are tax-free and the benefits of the new policy are tax-free. The following table lists the most common LTCI tax-free 1035 exchanges.

Click to Enlarge

Example of Tax-Free Exchange from a Life Insurance Policy to a Traditional Long Term Care Insurance Policy

The life insurance company completes a partial 1035 exchange each year to the Traditional LTCI company. If the life insurance company will not follow the rules the Internal Revenue Code allows, you can complete a 1035 exchange from a life insurance policy to an annuity. Then, complete a 1035 exchange from the annuity company to the Traditional LTCI company.

Example of Tax-Free Exchange from an Annuity Policy to a Traditional Long Term Care Insurance Policy

The annuity company completes a partial 1035 exchange each year to the Traditional LTCI company.

Example of Tax-Free Exchange from a Life Insurance Policy to a Combination Life and Long Term Care Insurance Policy

The life insurance company completes a one-time 1035 exchange to the Combination Life and LTCI company.

Requirements for 1035 Tax-Free Exchange

With an IRA, the custodian can issue a check and you have 60 days to rollover the proceeds to another custodian to avoid taxes. With an annuity or life insurance policy, the tax-free exchange must be made directly from the annuity company or life insurance company directly to the new company. You will not complete a tax-free exchange if you withdraw funds from the company directly, even if you use the money to purchase a new policy.

Action Step – Exchange Unnecessary Annuities and Life Insurance Policies into a Long Term Care Insurance Policy

As your life changes, your insurance needs may also change. When you complete a 1035 exchange you gain a tax free transfer of unnecessary insurance to necessary insurance. The long term care benefits of your new Traditional LTCI policy are tax free. The long term care and life insurance benefits of your Combination Life and Long Term Care Insurance policy are tax free.

Aaron Skloff, Accredited Investment Fiduciary (AIF), Chartered Financial Analyst (CFA) charter holder, Master of Business Administration (MBA), is the Chief Executive Officer of Skloff Financial Group, a Registered Investment Advisory firm. The firm specializes in financial planning and investment management services for high net worth individuals and benefits for small to middle sized companies. He can be contacted at www.skloff.com or 908-464-3060.